Which of the Following Are True of Financial Ratios

All but one of the following is true about quick ratios. If a company has inventory the quick ratio.

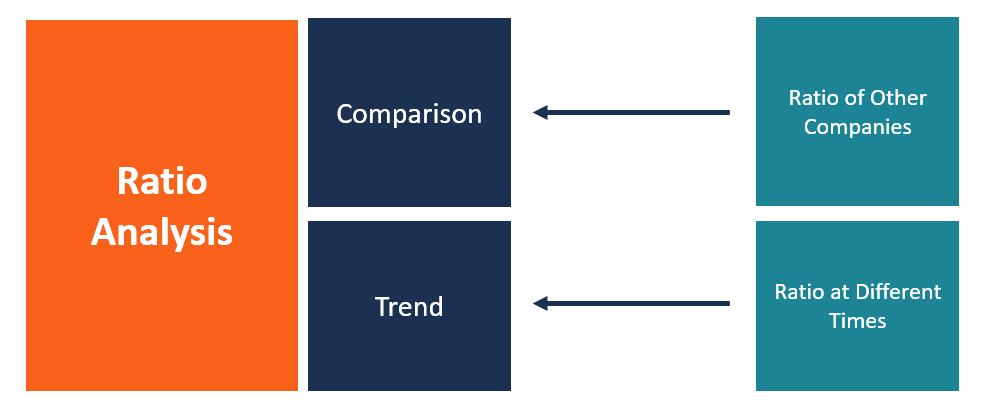

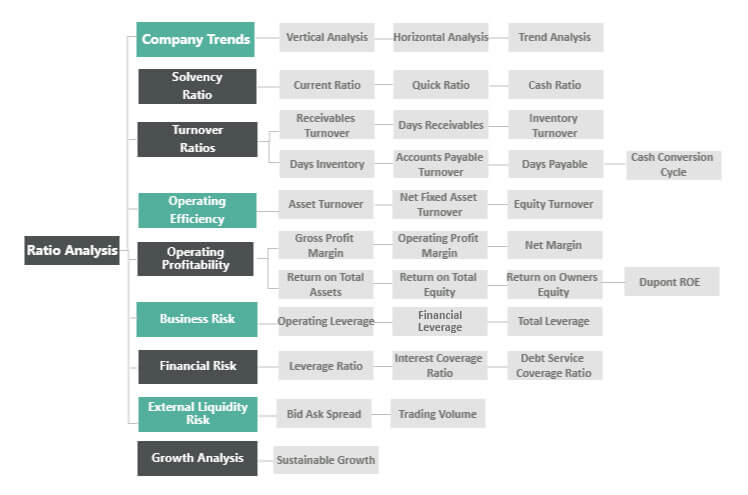

Ratio Analysis Overview Uses Categories Of Financial Ratios

Common liquidity ratios include the following.

. A Ratio analysis is useful in financial analysis. Knowing that a share price is 213 doesnt tell you much but knowing that the companys price-to-earnings ratio PE is 85 provides you with more context. A firm with a profit margin of 10 generates ______ in net income for every dollar in sales.

Ratio analysis is not. A Ratio analysis is used in financial analysis because it provides financial measurements in determining the financial. A The quick ratio is calculated by dividing the most liquid of current assets by current liabilities.

Financial statements are the end product of financial accounting process. 2 answers - Are used for comparison purposes - Are developed from a firms financial information. Which of the following statements concerning financial ratios is incorrect.

True True or false. Useful only for future predictions d. Click hereto get an answer to your question Which of the following statements are true about Ratio analysisa.

Net income Shareholders equity. On average the standard deviation of a portfolio declines as the number of assets in the portfolio is increased but it can not decline to zero. If you have difficulty answering the following questions learn more about this topic by reading our Financial Ratios Explanation.

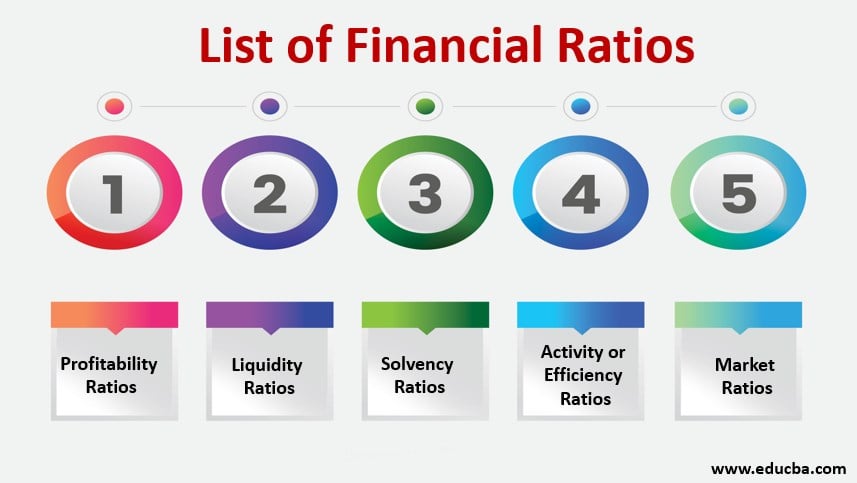

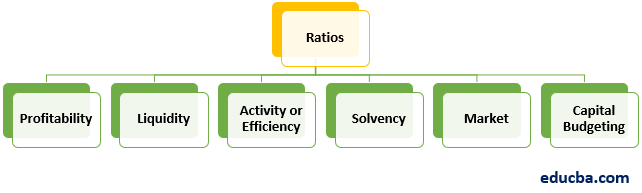

Financial ratios are relationships determined from a companys financial information and used for comparison purposes. A Gross profit ratio. Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations.

C Ratio Analysis is not helpful in identifying weak spots of the business. Return on equity is the measure of profitability of a business in relation with its equity. The correct answer is letter because A A B and D are true about Ratio Analysis.

A Ratio analysis is useful in financial analysis. B Service firms that tend not to carry too much inventory will see significantly higher quick ratios than current ratios. The current ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities.

Useful piece of information c. Systematic risk is all that matters to a well - diversified investor. In isolation which of the following is TRUE about a financial ratio.

C Either a or b d Both a b Ans. The debt-equity ratio equals the total assets minus total equity all over total assets. Examples include such often referred to measures as return on investment ROI.

Useful only for past performance b. The current ratio also known as the working capital ratio measures the capability of a business to. Which of the following statements are true about ratio analysis.

Spreading a portfolio across a number of assets will eliminate all of the risk. B Ratio analysis is helpful in communication and coordination. In the question debt ratio is 30.

Accounting principles and methods used by a company will not affect financial ratios the informational value of a ratio in isolation is limited a ratio is one number expressed as a percentage or fraction of another number calculation of financial ratios is not sufficient for a complete financial analysis of a. Current ratio is also known as acid test ratio. Liquidity ratios indicate the firms ability to pay its current liability.

Which of the following statements are true about Ratio Analysis. For fill-in-the-blank questions press or click on the blank space provided. Ratio analysis is helpful in communication and coordinationc.

All of the following statements are true regarding ratios that measure a companys ability to pay current liabilities except A Working Capital Current Assets Current Liabilities B A higher current ratio is always preferred to a lower current ratio. Which of the following is are true of financial ratios. B Operating profit ratio.

It tells you that when divided by its earnings per share EPS or 025 in this case its price 213 equals 85. Financial statements also disclose such facts which are not recorded in accounting books. Ratio analysis is useful in financial analysisb.

C Inventory being not very liquid is subtracted from total current assets to determine the most liquid assets. D Ratio Analysis is helpful in financial planning and forecasting. D Both a b 27.

Current assets on the common-size balance sheet over the past three years have increased from 32 to 35 percent while. So the debt value is 30 of the total assets 3 million. The information needed to compute the profit margin can be found on the _____.

Based on sales the following ratio can be considered important in judging the profitability of an enterprise. 5 rows Question 12 Which of the following are TRUE statements regarding the Financial Ratios. For multiple-choice and truefalse questions simply press or click on what you think is the correct answer.

A Ratio analysis is useful in financial analysis. Equity Total assets - Total debt.

How To Read Financial Statements Of A Company Financial Statement Accounting Education Accounting Basics

How To Read Financial Ratios Is Starhub A Bargain Financial Ratio Financial Return On Assets

Ratios That Helps You For Proper Analysis Stop Panicking About Your Liquidity Situation The Company S Ability To Pay It S Short Ter Financial Analysis Ratio

Cfi S Financial Ratios Cheat Sheet Is A Pdf Ebook Free And Available For Anyone To Download The Cheat Financial Ratio Financial Analysis Financial Statement

Ratio Analysis Definition Formula Calculate Top 32 Ratios

8 Financial Ratio Analysis That Every Stock Investor Should Know Financial Ratio Cash Flow Statement Stock Quotes

Types Of Financial Statements Accounting And Finance Accounting Education Financial Statement

Acc 560 Wk 11 Quiz 14 All Possible Questions Quiz Chapter Accounting Principles

List Of Financial Ratios Advantages Disadvantage Types Of Ratios

19 Most Important Financial Ratios For Investors Financial Ratio Investment Analysis Finance Investing

Financial Ratio Inventory Number Of Days While The Inventory Turnover Ratio Gives A Sense Of How Many Times The Company Replenishes Their Inventory The Inv

Pin On The Cogent Profit Platform

The 7 Most Important Personal Finance Ratios

Negative P E Ratio Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm Medium Personal Finance Organization Finance Meaning Fundamental Analysis

Financial Ratio Flashcards Analysis And Accounting By John Gillingham Financial Ratio Financial Analysis

Profitability Ratios Calculate Margin Profits Return On Equity Roe

Financial Ratios Quiz And Test Accountingcoach

Financial Ratios Financial Statement Analysis Financial Analysis Small Business Accounting Software

List Of Financial Ratios Advantages Disadvantage Types Of Ratios

Comments

Post a Comment